Eligibility

Joining is easy. You must be living or working within our common bond.

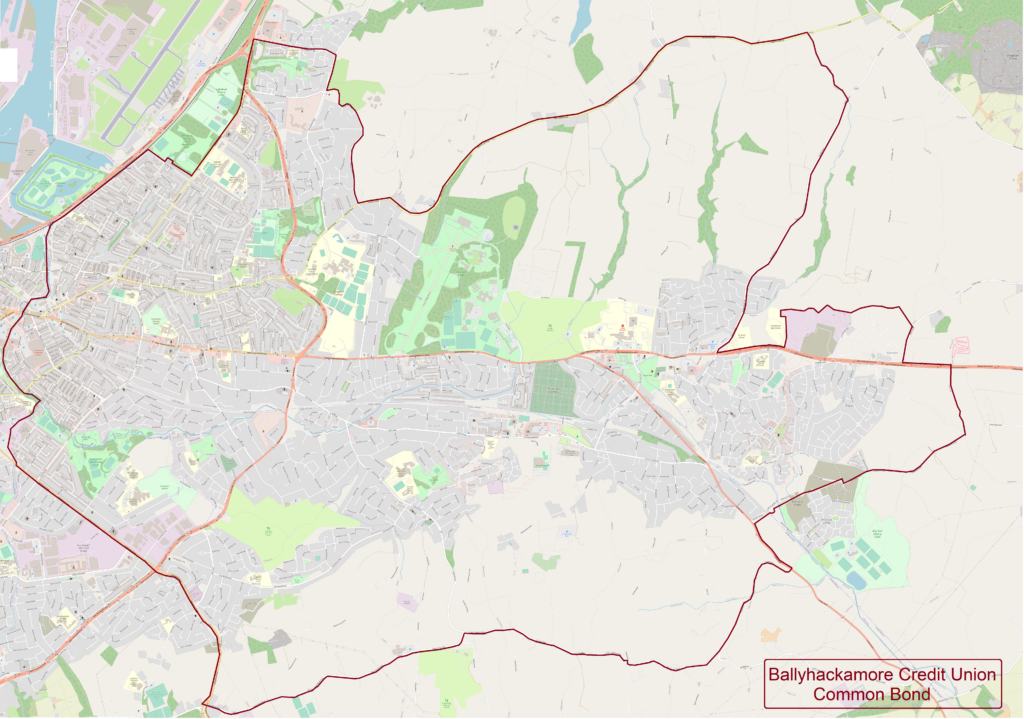

This covers most of BT4, BT5 and BT16. Here is a map to check your home or work address.

Join Online

Joining online is quick, secure and easy.

To join online, download our mobile app or click here.

You should have readily available:

You will also be asked to nominate someone, who, in the event of your death, will receive your property in the credit union.

You can save a partial application and return later. Make a note of the reference number.

During this process you will be invited to register for CuOnline. We suggest that you do this to enjoy the full benefits of your credit union membership.

Once notified that your membership has been approved you will be invited to call to the office to pay the £1 membership fee and start your savings with minimum £5 (max £500). At that time, you will sign any paperwork needed to complete the application process.

Then within 24 hours you will be able to:

When you are ready to join online, click the button below.

Join In-Office

You can join in our office during our opening hours. Forms are available in our office or online by clicking here. (download, print and bring into office – do not email).

You will need to bring with you:

Photographic ID

Address Verification

Membership Under 16

Minor accounts can be opened by a parent or guardian only.

To open an account for a minor under 16 we need:

If the minor is aged 7+, they must be present to open the account, and to make withdrawals.

Funds are held in trust for the minor. Withdrawals are only permitted for the Minor’s use and benefit.

2 months before reaching the age of 16, the credit union shall contact the minor and the signing parent or guardian to arrange upgrade of the account to an adult account where eligibility for an adult account is met. Where no action is taken the account will automatically transfer to an adult account if applicable, or be closed and funds returned to the minor. The account holder will have sole access to the funds from age 16.